With its open economy, low taxation, and strategic location, Hong Kong has long been a magnet for international business. For Indian investors, this global financial hub presents an opportunity and a powerful springboard into the wider Asia-Pacific region. The city’s business-friendly environment—marked by zero VAT, no dividend tax, and full foreign ownership—makes it an especially attractive option for those looking to business setup in hong kong.

With over 44,000 Indians residing in Hong Kong (including 32,790 Indian passport holders), the city also offers a culturally familiar and welcoming space for Indian entrepreneurs. As economic and cultural ties between India and Hong Kong continue to strengthen, more Indian businesses are recognising the immense potential of setting up operations here in Hong Kong.

This blog explores why starting a business in Hong Kong is a strategic move for Indian investors. From its historical roots to current government support, we’ll look at the factors that make Hong Kong a game-changing destination.

What is the Historical Business Link Between India and Hong Kong?

India’s ties with Hong Kong date back to the mid-19th century, shortly after the Treaty of Nanking. What began as a trade-driven relationship has expanded to include political visits, cultural exchanges, and substantial economic collaboration. In 1996, the Indian Commission was converted into the Consulate General of India, reflecting India’s long-term commitment to strengthening ties with Hong Kong.

Why is Hong Kong Ideal for Indian Investors?

1. Strategic Location and Gateway to China

Hong Kong serves as an ideal entry point into Mainland China. Its proximity and excellent logistics infrastructure make it a vital connector for Indian businesses wanting to access the massive Chinese market.

2. Ease of Doing Business

Hong Kong’s fast and straightforward company registration process is ranked highly in the World Bank’s Ease of Doing Business Index. You can set up a private limited company with minimal red tape within a week. Learn more at the Hong Kong Companies Registry.

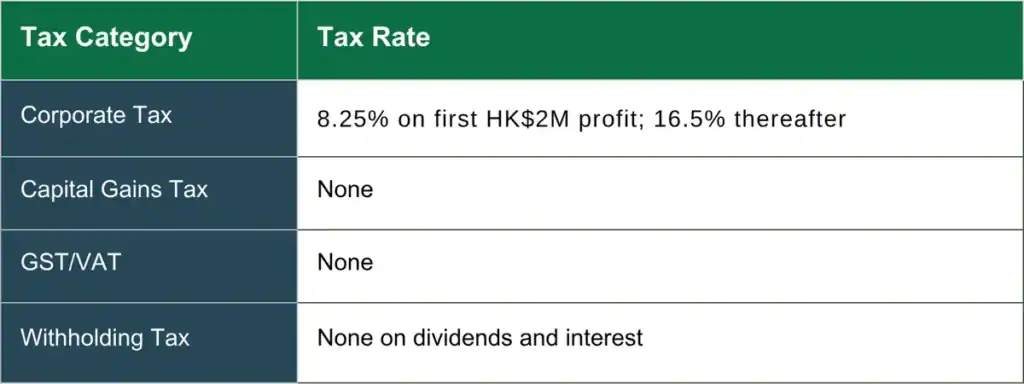

3. Favourable Tax Regime

Hong Kong’s tax system is one of the most investor-friendly in the world. Various incentives are also available for small and medium enterprises (SMEs), making it a cost-efficient base for startups.

Read Our Guide: How To Set Up An Offshore Company In Hong Kong 2025 Guide

How Strong is India-Hong Kong Bilateral Trade?

India and Hong Kong have cultivated strong and enduring trade relations over the decades. In FY 2023–24, bilateral trade between the two economies stood at an impressive US$28.69 billion, underscoring Hong Kong’s importance as a strategic trade partner for India.

1. Top Indian Exports to Hong Kong:

- Gems and Jewellery

- Electrical Machinery and Equipment

- Pharmaceuticals

- Textiles and Cotton Products

- Organic Chemicals

2. Top Imports from Hong Kong:

- Electronic Components and Devices

- Optical and Scientific Instruments

- Plastics and Plastic Articles

- Watches and Precision Instruments

Hong Kong ranks as India’s 12th-largest export destination and 11th-largest source of imports, reflecting a well-balanced and mutually beneficial trade relationship.

What Government Agreements Support Indian Investors in Hong Kong?

Indian investors benefit from a variety of agreements between the two regions, such as:

| Agreement | Purpose & Benefits | Reference Link |

|---|---|---|

| Double Taxation Avoidance Agreement (DTAA) (2018) | Avoids double taxation on income; reduces withholding tax on dividends, interest, and royalties for Indian investors. | DTAA Full Text – IRD Hong Kong |

| Customs Cooperation Agreement | Facilitates efficient customs procedures, improves enforcement against smuggling, and ensures smooth movement of goods. | Customs Department – HK Gov |

| Air Services Agreement | Enhances direct air connectivity between India and Hong Kong, boosting business travel and cargo movement. | Transport and Logistics Bureau – HK Gov |

| Surrender of Fugitive Offenders Agreement | Ensures extradition of offenders, reinforcing legal certainty for businesses and investors. | Security Bureau – HK Gov |

| Mutual Legal Assistance Treaty (MLAT) | Promotes cooperation on criminal matters, providing legal support in investigations and prosecution. | Department of Justice – HK Gov |

Which Key Industries Offer Opportunities for Indian Entrepreneurs in Hong Kong?

Hong Kong offers Indian businesses numerous opportunities across a range of sectors:

1. Financial Services and Fintech

- Global financial hub hosting over 70 of the world’s top 100 banks

- A growing fintech ecosystem backed by government initiatives

Example: Paytm, one of India’s leading fintech firms, has explored Hong Kong for its capital-raising and cross-border digital payment infrastructure due to the city’s financial openness and international investor base.

2. Innovation and Technology

- Strong R&D infrastructure

- Government funding and incentives for tech startups

- Emerging hub for cybersport and digital entertainment

Example: Tech Mahindra has established a technology and innovation office in Hong Kong to collaborate on 5G, IoT, and AI solutions tailored for Asia-Pacific clients.

3. Professional Services

- Increasing demand for legal, accounting, and consulting services

- Acts as a gateway for offering services in Mainland China

Example: Indian firms such as Desai & Diwanji and Singhania & Co. are providing cross-border legal services from Hong Kong to clients expanding into China and Southeast Asia.

4. Trading and Logistics

- Strategic position in the Asia-Pacific region

- World-class seaport and airport facilities enhance global trade connectivity

Example: Tata International uses Hong Kong as a distribution centre for leather goods, machinery, and steel, leveraging its customs efficiency and geographic access to Asia-Pacific markets.

What are the Visa Facilitation Benefits for Indian Employees in Hong Kong?

Hong Kong has recently introduced new visa measures to make it easier for foreign talent, including Indian professionals, to relocate for work.

1. Priority Processing for Foreign Staff

Employees of Hong Kong-registered companies now enjoy priority processing by presenting documents such as a staff card, business card, or employment contract. This fast-track process reduces wait times significantly and helps get Indian staff on-site quicker.

2. Urgent Visa Processing for Mainland China Travel

Hong Kong also supports urgent visa processing for Indian staff travelling to Mainland China. Visas can be issued as early as the next working day, offering flexibility for time-sensitive business matters.

What Legal and Cultural Compliance Must Indian Businesses Follow in Hong Kong?

Setting up and running a business in Hong Kong involves more than legal paperwork. Here are key considerations about Hong Kong:

Cultural and Business Practices

Legal and Regulatory Compliance

Support Networks and Resources

Language and Communication

Quick Facts

|

How Can Indian Investors Start a Company in Hong Kong?

Starting a business in Hong Kong involves a few straightforward steps:

1. Choose a Company Type

Most foreigners opt for a Private Limited Company due to limited liability and full foreign ownership.

2. Select a Company Name

Ensure your company name is unique and complies with Companies Registry rules. You can check availability online.

3. Appoint a Company Secretary

Must be a Hong Kong resident or a local company. They handle compliance and filings.

4. Register the Company

Submit incorporation forms and documents to the Companies Registry. You’ll receive your Business Registration Certificate from the IRD.

5. Open a Business Bank Account

Provide company documents, ID, and proof of address. Most banks require in-person verification, though fintech options are available.

6. Apply for Licences (If Needed)

Certain businesses (e.g., F&B, trading, finance) require sector-specific licences from local authorities.

You can refer to the Hong Kong Companies Registry for more.

Conclusion

Hong Kong is more than just a global city; it’s a business gateway to the rest of Asia. Beyond its strategic business advantages, Hong Kong offers Indian entrepreneurs a dynamic and cosmopolitan lifestyle. The city’s rich cultural diversity, excellent international schools, world-class healthcare, and vibrant culinary scene create an inviting environment for families and professionals alike. Coupled with efficient public transport and proximity to stunning natural escapes, Hong Kong not only supports business growth but also provides a high quality of life — making it an ideal destination for Indian investors looking to establish both a prosperous business and a fulfilling personal life.

Now is the perfect time to seize the opportunity and establish your business in Hong Kong.

Need help with incorporation? 3E Accounting Services offers end-to-end business registration support tailored for Indian investors.

Incorporate Your Business in Hong Kong Today!

Take the first step towards expanding into Asia. Let 3E Accounting Services help you set up your Hong Kong business smoothly and efficiently.

Frequently Asked Questions

Yes, a foreigner can absolutely open a company in Hong Kong. There are no restrictions on foreign ownership, and you do not need to be a resident or hold a local visa to incorporate a company. This makes Hong Kong a preferred destination for global entrepreneurs, including Indian investors.

No, you do not need to be physically present in Hong Kong to register a business. Most of the setup process, including document submission and even opening a bank account, can be handled remotely with the help of a licensed service provider.

Yes. Indian passport holders must register under Hong Kong’s Pre-Arrival Registration (PAR) system for short stays and apply for a business visa for long-term stays.

Some banks allow remote onboarding, but most require at least one in-person visit. Partnering with a firm like 3E Accounting simplifies the Hong Kong business bank account process.

Typically, it takes 5–7 working days to complete the Hong Kong company registration process.

The DTAA helps Indian businesses avoid being taxed twice on the same income, optimising tax liabilities and making operations in both jurisdictions more efficient.

Abigail Yu

Author

Abigail Yu oversees executive leadership at 3E Accounting Group, leading operations, IT solutions, public relations, and digital marketing to drive business success. She holds an honors degree in Communication and New Media from the National University of Singapore and is highly skilled in crisis management, financial communication, and corporate communications.