Setting up an offshore company is often wise for entrepreneurs and global businesses aiming to optimise taxes, protect their assets, and manage international operations more effectively. Hong Kong stands out among the world’s offshore destinations due to its robust legal framework, efficient incorporation process, and territorial tax system, which may allow certain overseas income to be tax-exempt.

With proper planning and the right business model, registering a company in Hong Kong while trading outside its borders can provide genuine tax benefits without the complications of more traditional low-tax jurisdictions.

This guide will explain a Hong Kong offshore company, its legal requirements, the steps to establish a business in Hong Kong, and the key compliance points to remember

What Is a Hong Kong Offshore Company?

A Hong Kong offshore company is a business registered in Hong Kong that conducts all its commercial activities outside the city. Even though it’s incorporated under Hong Kong law, its operations, clients, and transactions are overseas.

This setup may make the company eligible for tax exemptions under Hong Kong’s territorial tax system, which means only income sourced within Hong Kong is taxable. Offshore income may not be taxed if proper conditions are met.

Unlike traditional “tax haven” jurisdictions such as the British Virgin Islands, Hong Kong is internationally recognised, fully regulated, and known for its transparent governance and legal systems. Business owners benefit from:

- A precise and dependable legal system

- Strong banking and financial services

- A trusted global reputation

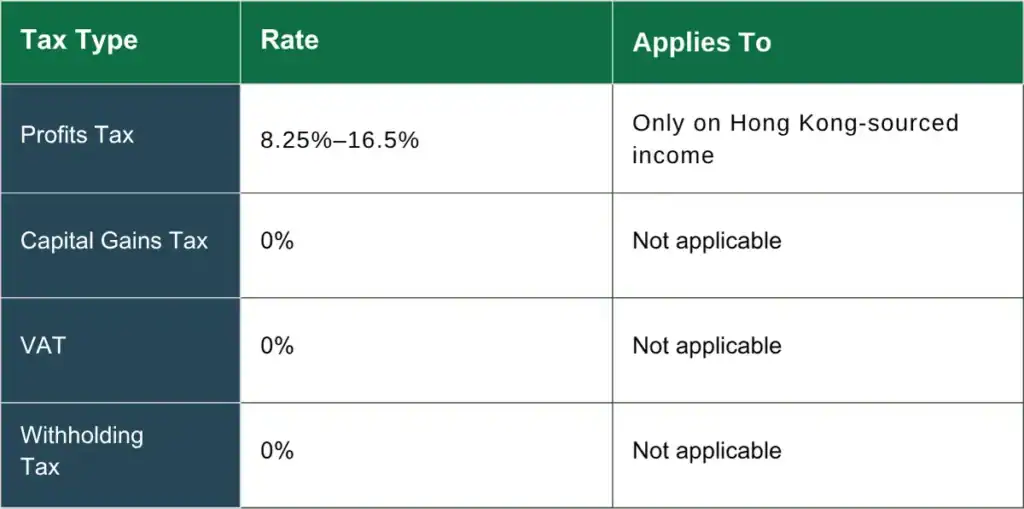

- No capital gains tax, no VAT, and no withholding tax

- The ability to open multi-currency bank accounts

This makes Hong Kong a desirable destination for global entrepreneurs who want tax efficiency and business credibility.

What are the Benefits of Setting Up an Offshore Company in Hong Kong?

Hong Kong has earned a solid reputation as a global business hub. It is particularly favoured for its ease of business and reliable financial system. Establishing an offshore company here brings many advantages for entrepreneurs looking to operate internationally.

1. Prime Geographic Location

Situated in the heart of Asia, Hong Kong offers direct access to key markets across the region and beyond. Its strategic positioning makes it an excellent global trade and cross-border operations launchpad.

2. Attractive Tax System

One of the most appealing aspects of incorporating in Hong Kong is its tax structure. Profits from activities conducted outside of Hong Kong may not be subject to local tax, provided certain conditions are met. Additionally, there is no capital gains tax, VAT, or dividend withholding tax, making it a tax-efficient jurisdiction.

3. No Requirement for Minimum Share Capital

Unlike many other countries, Hong Kong does not enforce a minimum capital threshold to start a company. This gives founders the flexibility to begin operations without committing significant upfront funds.

4. World-Class Financial Infrastructure

Hong Kong is a leading international financial centre with a modern banking system and a wealth of financial services. This makes it easier for offshore companies to handle international payments and manage their finances effectively.

5. Global Credibility

A company registered in Hong Kong is considered credible in the global market. The country’s strong legal system and regulatory transparency enhance a business’s credibility, which can be valuable when building trust with clients, partners, and investors worldwide.

What are the Legal Requirements for Offshore Companies in Hong Kong?

Before you get started, it’s essential to understand what the law requires. Hong Kong’s incorporation process is straightforward, but staying compliant is key.

-

Company Name and Structure

You must pick a unique name and choose a business structure—usually a private limited company. Your name must comply with the Companies Registry naming guidelines.

-

Directors and Shareholders

At least one director and one shareholder are needed. They can be the same person and don’t have to be Hong Kong residents.

-

Company Secretary

You’re legally required to appoint a company secretary who is a Hong Kong resident or a registered local company. They help manage your company’s records and compliance duties.

-

Share Capital

The minimum requirement is HKD 1. No capital duty or upper limit applies.

-

Registered Office Address

For official correspondence, you must have a local address in Hong Kong, not a P.O. Box.

-

Necessary Documentation

You’ll need to file incorporation documents, including the Articles of Association, details of directors and shareholders, and proof of your registered address.

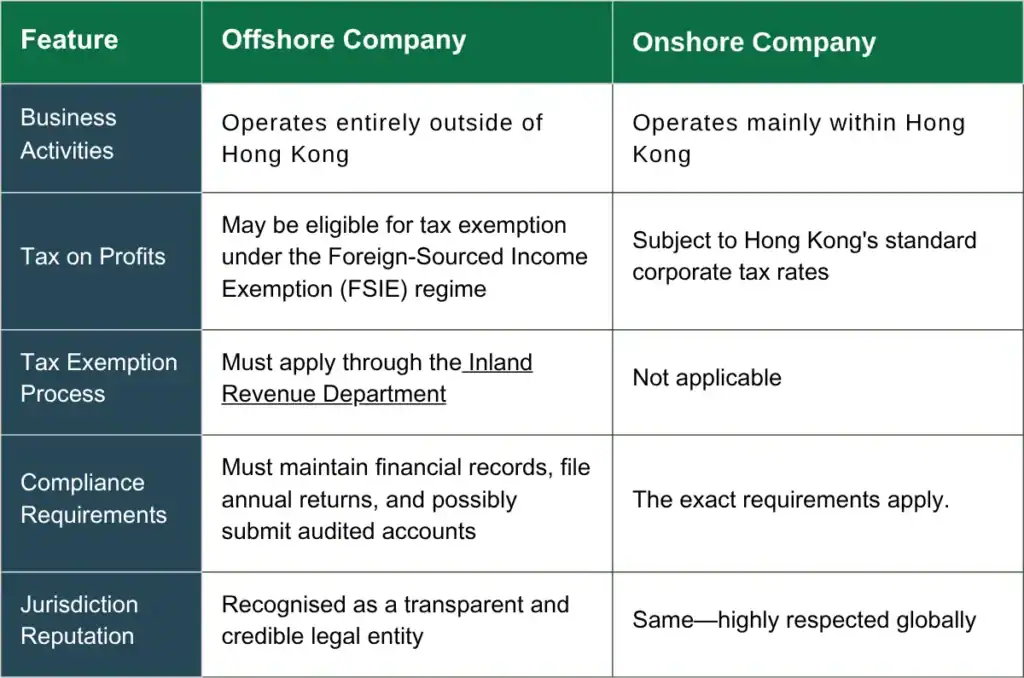

What is the Difference Between Offshore and Onshore Companies in Hong Kong?

It’s normal for new business owners to confuse offshore and onshore companies in Hong Kong. Although both are registered under the same legal framework, how they operate—and how they’re taxed—differs significantly. Here’s a straightforward comparison to help clear things up:

What are the Steps to Register a Hong Kong Offshore Company?

Setting up an offshore company in Hong Kong is relatively smooth, especially with the city’s efficient online systems and business-friendly regulations. Below is a straightforward step-by-step guide to help you confidently navigate the incorporation process.

1. Choose a Company Name

The first step is selecting a unique name for your company. You can check name availability using the Hong Kong Companies Registry’s online search portal. It’s essential that the name complies with local naming rules and does not resemble any existing company.

2. Decide on the Company Type

A private limited company is the preferred structure for most offshore business needs. It offers limited liability protection, is flexible regarding ownership, and is recognised internationally.

3. Prepare and Submit Incorporation Documents

Prepare the required documents once you’ve settled on a name and company type. These typically include:

- The Articles of Association

- Copies of identity documents for directors and shareholders

- A registered office address in Hong Kong

All documents can be submitted via the e-Registry platform, where you’ll also pay the applicable government fees.

4. Obtain Your Business Registration Certificate

After your application is reviewed and approved—usually within 3 to 5 working days—you’ll be issued the following:

- A Certificate of Incorporation

- A Business Registration Certificate from the Inland Revenue Department

These documents prove that your company is legally recognised and ready to operate.

What Are the Post-Incorporation Compliance Requirements for a Hong Kong Offshore Company?

Once your offshore company is set up, you must comply with Hong Kong’s legal and regulatory requirements to keep it in good standing.

1. File Annual Returns

Submit your annual return to the Companies Registry each year to update your company’s information and maintain its legal status.

2. Keep Proper Records

Maintain accurate bookkeeping and financial records, even if your company operates outside Hong Kong.

3. Renew Business Registration

The Business Registration Certificate must be renewed annually through the Inland Revenue Department.

4. Prepare Audited Financial Statements

If your company meets the relevant criteria, audited financial statements must be prepared and submitted as part of your tax obligations.

5. Open a Company Bank Account

Finally, you must open a corporate bank account to manage your business transactions. Hong Kong offers access to local and international banks supporting multi-currency operations.

Read our guide: How to Register a Business in Hong Kong: The Complete Guide for 2025

What are the Tax Benefits and Obligations for a Hong Kong Offshore Company?

Hong Kong’s territorial tax system only taxes profits earned within the city. You may qualify for “offshore status” – an exemption from Hong Kong tax – if your income is exclusively generated outside Hong Kong. Visit the Inland Revenue Department for complete details.

Conclusion

Opening an offshore company in Hong Kong can offer numerous benefits for foreign entrepreneurs looking to expand their business globally, from favourable tax and regulatory regimes to access to international markets. If you want to operate a business internationally with greater freedom and fewer barriers, establishing your company in Hong Kong is a strategic choice. It provides the credibility, infrastructure, and global reach many entrepreneurs seek, without the bureaucratic hurdles often encountered elsewhere.

With the proper preparation and a clear grasp of the legal requirements, your offshore company can run efficiently and stay focused on what truly matters: expanding your business across borders.

At 3E Accounting, we care for everything for you—from name registration to secretarial services, compliance, and even bank account setup. Let us simplify your offshore journey so you can focus on growing your business internationally.

Ready to go global? Contact us today for a free consultation, and let’s build your offshore success story together.

Ready to Start Your Hong Kong Offshore Company?

Start your Hong Kong offshore company with confidence. Speak with 3E Accounting Services and get it right from day one.

Frequently Asked Questions

Yes, foreigners can fully own and manage a Hong Kong offshore company. There are no restrictions on nationality for directors or shareholders.

To qualify, your company must prove that all business operations and income are generated outside of Hong Kong. You must apply for exemption through the Inland Revenue Department (IRD) with supporting documents.

Typically, the company incorporation process takes around 3 to 5 working days, provided all documents are correctly submitted via the e-Registry portal.

Yes, a local registered address in Hong Kong is required, but it cannot be a PO Box. This address is used for receiving official government correspondence.

Yes, every Hong Kong company must appoint a company secretary who is either a Hong Kong resident or a licensed corporate service provider like 3E Accounting.

Yes, you can open a multi-currency corporate bank account. Hong Kong is known for its robust banking infrastructure, making it easier for offshore companies to conduct international transactions.

Abigail Yu

Author

Abigail Yu oversees executive leadership at 3E Accounting Group, leading operations, IT solutions, public relations, and digital marketing to drive business success. She holds an honors degree in Communication and New Media from the National University of Singapore and is highly skilled in crisis management, financial communication, and corporate communications.

![5 Steps to Register a Company in Hong Kong Online [2026]](https://www.3ecpa.com.hk/wp-content/uploads/2026/03/5-Steps-to-Register-a-Company-in-Hong-Kong-Online-2026-scaled-110x80.webp)