Hong Kong remains a top destination for entrepreneurs and businesses looking to establish a presence in Asia. Its strategic location, business-friendly environment, and straightforward company registration process make it an attractive option for local and international investors. The Hong Kong private limited company (also known as a Hong Kong Ltd.) is the most popular form of Hong Kong company. It offers its owners favourable tax laws and a rock-solid international reputation. Furthermore, Hong Kong has a well-developed legal and financial system and is widely known as a global business centre.

According to the Companies Registry, as of March 31, 2024, Hong Kong had 1,413,761 private limited companies registered locally. In addition, 14,932 non-Hong Kong private companies were registered from 83 countries, reflecting the region’s appeal as a global business hub.

In this guide, we’ll walk you through the step-by-step process on how to set up business in Hong Kong in 2025. Whether you’re a first-time entrepreneur or looking to expand your business internationally, our comprehensive guide aims to simplify every aspect of the company registration process.

What Is a Private Limited Company in Hong Kong?

A Private Limited Company is a private company limited by shares. It operates as a legal entity and can conduct business while benefiting from various advantages.

These private companies may also be called “PVT LTD” in the Companies Registry. Shareholders’ liability is limited to the number of shares they have subscribed for. Shareholders of a private company are not personally liable for any debts incurred by the company.

Private companies typically restrict the transfer of shares. Even if the Articles of Association do not restrict the transfer, the company may refuse to register it.

Why Choose a Private Limited Company in Hong Kong?

A Private Limited Company (Ltd) is the most popular business structure in Hong Kong. Here’s why:

- Limited Liability: Shareholders’ assets are protected; they’re only liable for the company’s debts up to the amount they invested.

- Separate Legal Entity: The company is treated as a separate legal person, meaning it can own property, enter into contracts, and sue or be sued in its name.

- Tax Benefits: Hong Kong’s tax regime is simple and low, with a two-tiered profits tax system.

- No Capital Gains Tax: No dividends or capital gains tax exists.

- Ease of Doing Business: Hong Kong ranks highly in global ease of doing business indices.

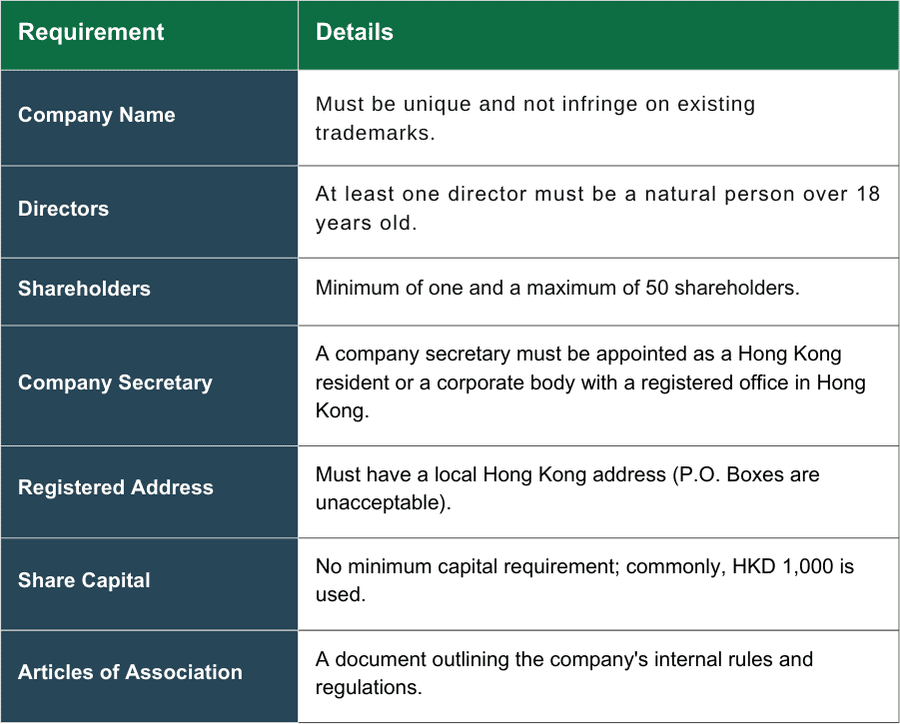

What are the Key Requirements for Private Company Registration in Hong Kong?

A private limited company is a distinct legal entity managed by a board of directors. The shareholders appoint the directors responsible for managing the company’s affairs and can appoint officers to oversee the day-to-day operations.

Here are the minimum requirements one must fulfil to set up a private company in Hong Kong:

Step-by-Step Company Registration Process in Hong Kong

Company registration in Hong Kong is straightforward and efficient. Here’s a more detailed step-by-step breakdown:

Choosing a Company Name

Choose a unique name that complies with Hong Kong’s naming rules. It can be in English, Chinese, or both. Ensure it’s not already taken or is not too similar to another registered business by check company name availability Hong Kong using the Companies Registry search tool.

- Avoid sensitive words like “bank”, “insurance”, or “trust” unless you’re correctly licensed.

- The name must end with “Limited” or “Ltd”.

Preparing Documents

You’ll need to gather and prepare several documents before submitting your application:

- Articles of Association (standard templates are often acceptable)

- Form NNC1 – Incorporation Form for private companies

- Registered office address in Hong Kong (can be a commercial address or virtual office)

- Identification documents for all directors, shareholders, and the company secretary (HKID or passport)

- Consent to Act as Director form

Submitting the Application

You can submit your application in one of two ways:

- Online via the e-Registry – fast and paperless

- In person or by post at the Companies Registry office

When submitting, include:

- Completed Form NNC1

- Signed Articles of Association

- Application fee (usually payable by card or cheque)

Government Fees and Timelines

The standard government incorporation fee is HK$1,720. If you register company hong kong online and submit all correct documents, your company is typically incorporated within one business day. Paper applications take slightly longer (3–5 working days).

Note:

- The Company Registration Certificate fee is separate and depends on the certificate period (1 or 3 years).

Receiving Incorporation Certificates

Once approved, you’ll receive two key documents:

- Certificate of Incorporation – the legal birth certificate of your company

- Business Registration Certificate – allows you to start company in hong kong.

These can be downloaded electronically via the e-Registry or collected in person if you applied offline.

Once you receive these certificates, your Hong Kong private limited company is officially registered and ready to operate.

What are the Post-Incorporation Requirements for companies in Hong Kong?

After your company is registered, there are several essential steps to take:

Open a Corporate Bank Account:

Traditional Hong Kong banks require a certified copy of company documents for corporate account opening. Additionally, some of them necessitate the physical presence of the account holders during the process.

Alternatives to traditional banks for opening a business account in Hong Kong include virtual banks or payment providers.

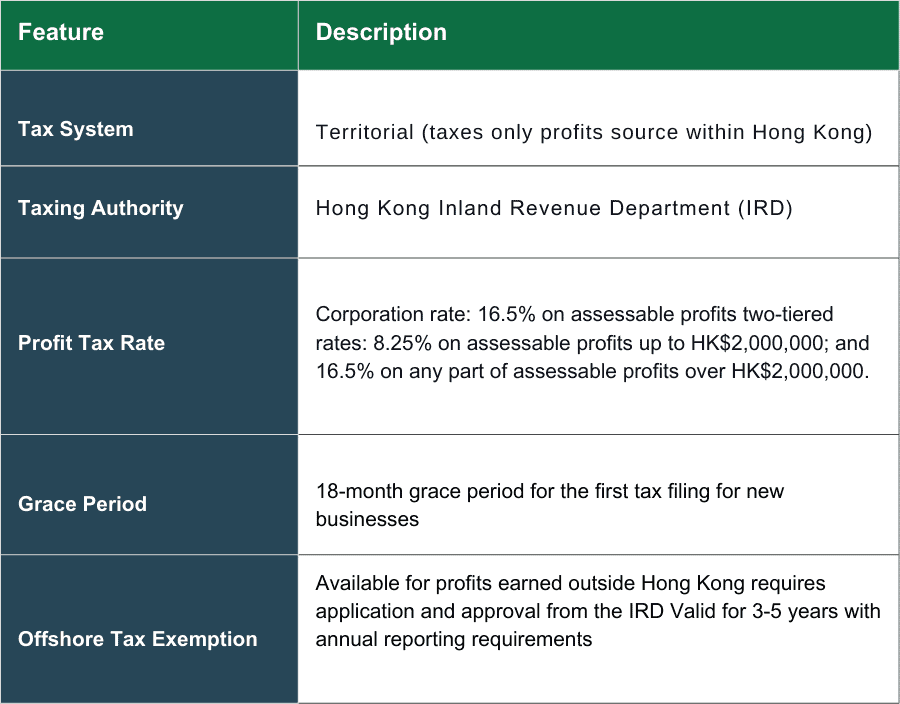

Register for Taxes:

Hong Kong operates on a territorial tax system, which means that only profits derived from Hong Kong are subject to taxation. The Hong Kong Inland Revenue Department administers corporate taxes and capital gains tax in Hong Kong. It is responsible for ensuring tax compliance and collection.

Taxation for Private Limited Companies in Hong Kong

Maintain Proper Records, Comply with Ongoing Obligations:

Limited companies in Hong Kong must file annual returns to maintain compliance with local regulations, prepare audited financial statements and tax returns, and hold an annual general meeting as part of their compliance requirements.

Further daily fines may be enforced if the Company Registration Certificate is not renewed in time. Private companies limited by shares in Hong Kong are subject to ongoing compliance requirements to ensure adherence to local regulations.

Conclusion

Setting up a Private Limited Company in Hong Kong in 2025 is straightforward and offers numerous benefits, including limited liability, tax advantages, and a strategic location for business in Asia. Following the steps outlined in this guide and ensuring compliance with local regulations can establish a solid foundation for your business venture.

At 3E Accounting services, we specialise in assisting entrepreneurs and businesses with company registration and compliance in Hong Kong. Our experienced team is here to guide you through every step of the process, ensuring a smooth and hassle-free experience.

Let us take the hassle out of your business registration in Hong Kong. Contact 3E Accounting today, and learn how we can help you achieve your business goals

Ready to start your business journey in Hong Kong?

Why go it alone? From document preparation to post-incorporation support, 3E Accounting makes Hong Kong company registration smooth and simple. Schedule your consultation now!

Frequently Asked Questions

Yes, foreigners can fully own and operate a Private Limited Company in Hong Kong.

To appoint a director in a Private Limited Company in Hong Kong, the shareholders must pass a resolution approving the appointment. The company should then update its statutory records, notify the Companies Registry by filing the required form, and issue a letter of appointment to the new director.

A Private Limited Company can issue ordinary or preference shares with special voting rights. Articles of Association should include the nature/class of shares and voting rights attached to them.

Government fees for company registration start from HKD 1,720. Additional costs include service provider fees, a company secretary, and office address. Full packages usually start from around HKD 5,000 to HKD 8,000.

Unlike a private company which restricts share transfers and limits the number of shareholders, a public company allows its shares to be freely traded on a stock exchange.

Public companies also need to fulfill stringent reporting requirements.

A Private Limited Company in Hong Kong can have between 1 and 50 owners (shareholders), making it an ideal choice for small to medium-sized businesses seeking flexibility in ownership structure.

Abigail Yu

Author

Abigail Yu oversees executive leadership at 3E Accounting Group, leading operations, IT solutions, public relations, and digital marketing to drive business success. She holds an honors degree in Communication and New Media from the National University of Singapore and is highly skilled in crisis management, financial communication, and corporate communications.

![5 Steps to Register a Company in Hong Kong Online [2026]](https://www.3ecpa.com.hk/wp-content/uploads/2026/03/5-Steps-to-Register-a-Company-in-Hong-Kong-Online-2026-scaled-110x80.webp)