Hong Kong is a global business hub known for its strategic location, business-friendly environment, and robust legal framework. These make it an attractive destination for entrepreneurs and companies seeking to establish a presence in Asia. Company formation in Hong Kong is relatively straightforward and offers numerous advantages, including low tax rates, access to international markets, and simplified administrative procedures.

Whether you’re a first-time business owner or an experienced entrepreneur looking to expand, it’s essential to understand the registration process in Hong kong thoroughly. This comprehensive guide will cover everything you need to know about registering a business in Hong Kong, from the compelling reasons to choose this vibrant city to the necessary documentation and step-by-step registration process. Whether your venture is a startup or an established enterprise, this article will equip you with the essential knowledge to successfully set up your business in Hong Kong. Let’s start making your business dreams in Hong Kong a reality!

Why Choose Hong Kong for Your Business Registration?

With its excellent reputation for efficiency, Hong Kong maintains the title of the world’s most liberal business economy, and Hong Kong is recognized as a perfect destination for entrepreneurs. Hong Kong offers a host of benefits for businesses:

- Strategic Location: Right at the heart of Asia, close to mainland China, providing easy access to the Chinese market

- Ease of Doing Business: Straightforward and quick processes with minimal red tape.

- Robust Legal Framework: A reliable, transparent legal system based on English common law.

- Business-Friendly Climate: Efficient regulations and a government that supports entrepreneurship.

- Skilled Workforce: A highly productive, trained, and skilled workforce.

- Favourable Tax Policies: Including no capital gains tax and territorial-based taxation.

- Unrestricted Capital Flow: No investment limits in or out of Hong Kong.

- Bilateral Trade Deals: Signed agreements with over 30 countries for favourable trade treatment.

- Foreign Ownership: Foreigners can own and manage a company by obtaining a work visa.

- World-Class Infrastructure: Including top-tier transport, telecommunications, and office facilities.

- Government Support: Numerous public and private sector schemes exist to help businesses grow.

What are the Types of Business Entities in Hong Kong?

Before you set up a company in Hong Kong, it is essential that you know the different types of business entities in Hong Kong and how they operate, as each entity has diverse characteristics. Choosing the appropriate structure is the most crucial step and should be based on your business objectives. Below are the different types of entities that you may consider setting up.

Sole Proprietorship

A sole proprietorship is the simplest business structure available in Hong Kong. In a sole proprietorship, a single individual owns and operates the business. The owner bears full responsibility for all profits and losses, as there is no legal distinction between the individual and the business itself. The owner must register the business with the Business Registration Office under the Inland Revenue Department to operate legally.

Partnership

A partnership is formed when two or more individuals agree to run a business together and share its profits and responsibilities. Hong Kong permits up to 20 partners in a single partnership. There are two common types: general and limited partnerships. All partners are equally liable for the business’s debts and actions in a general partnership. In contrast, a limited partnership allows certain partners to limit their liability to the amount of capital they have invested, while general partners retain full liability.

Private Limited Company

This structure is a popular choice among small to medium-sized businesses. A private limited company is a separate legal entity from its owners, offering limited liability protection to its shareholders. The number of shareholders is restricted to 50, and shares cannot be provided to the general public.

Public Limited Company

A public limited company (PLC) allows shares and other securities to be publicly traded, typically through a stock exchange. These companies can have more than 50 shareholders and are generally subject to more stringent regulatory requirements. PLCS are suitable for larger enterprises seeking to raise capital from the public.

Branch Office

Foreigners looking to establish a company in Hong Kong often opt to set up a branch office in Hong Kong. While a branch operates as an extension of the parent company, it must be registered with the Companies Registry. The parent company retains full liability for the branch’s operations. Although not a separate legal entity, a branch office can carry out business activities and generate revenue within Hong Kong.

What are the Steps for Business Registration in Hong Kong?

The following is the process of registering a company in Hong Kong:

1. Decide on the Company Structure

The first step involves selecting the appropriate type of company to form. This choice influences the legal benefits, tax obligations, and registration requirements. Business owners should choose a structure that aligns with their goals and operational needs. A private limited company is typically the most suitable option for foreign individuals wishing to set up a business remotely in Hong Kong.Each structure has different legal and tax implications, so evaluate which suits your business best. The types of business structures are discussed in detail above in this blog.

2. Choose a Company Name

When deciding on a company name, it must be unique and not already listed in the Registrar of Companies’ database. Additionally, the name must not infringe on any existing trademarks or intellectual property rights. A proper suffix must also be included to reflect the type of company—private limited companies, for instance, must end with the word “Limited. ”Check availability through the Companies Registry.

3. Appoint Key Personnel

Every Hong Kong company must have:

- At least one director (aged 18+, not bankrupt or convicted, can be of any nationality)

- At least one shareholder (individual or corporate, up to 50 allowed)

- A company secretary (must be a Hong Kong resident or licensed firm; cannot be the sole director)

These roles are essential for legal compliance and smooth governance.

4. Allocate Share Capital

No minimum share capital is required, but you must issue at least one share. Shares can be denominated in any primary currency. The issued capital equals the number of shares multiplied by their par value.

5. Set a Registered Office Address

You must have a physical address in Hong Kong for official correspondence (P.O. boxes not accepted). Consider using a professional service provider if you don’t have an office.

6. Submit Registration Documents

To officially register the company, applicants must submit the necessary forms and the applicable fees. This can be done online via the e-Registry, the CR eFiling app, or in person at the Government Offices. The required documents include:

- The incorporation form

- A copy of the company’s articles of association

- A notice to the Business Registration Office

Once the application is approved, the Certificate of Incorporation and the Business Registration Certificate will be issued. These documents, which hold equal legal authority, may be delivered electronically or in hard copy.

7. Obtain the Required Business License

Although many businesses in Hong Kong operate without special permits, certain industries require specific licences. Entrepreneurs should consult the Trade and Industry Department’s website for details on licences and permits necessary for particular business activities, including those involving import and export.

8. Set Up a Business Bank Account

Opening a corporate bank account in Hong Kong is crucial in establishing the company’s financial operations. Banks will request documentation to verify the company’s legal status, such as the Certificate of Incorporation and other proof of business activities. These documents must be submitted along with a formal application for the bank account.

Read our guide on: Open International Offshore Bank Account for Hong Kong Company

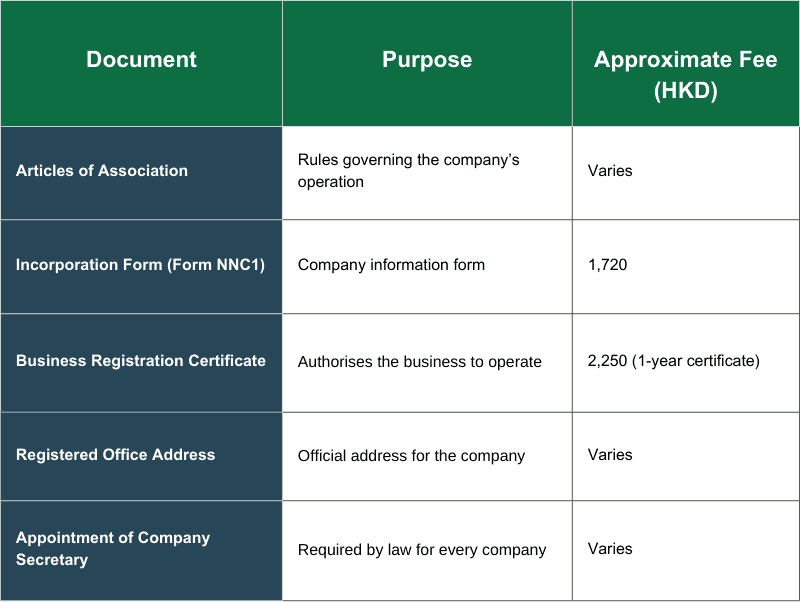

What are the Required Documents and Fees for Business Registration in Hong Kong?

To register a company in Hong Kong, you must submit the Articles of Association and a completed incorporation form detailing the company name, address, business activities, and particulars of directors, shareholders, and the company secretary.

Non-resident directors/shareholders must provide passport copies and proof of address; local individuals must submit Hong Kong ID copies. Corporate shareholders must also submit a copy of the parent company’s registration certificate.

What are the Post-Registration Obligations for businesses in Indonesia?

Once your business is up and running, you’ll have ongoing responsibilities:

- Filing Annual Returns: Submit to the Companies Registry each year.

- Renew Business Registration: Typically renewed every year through the Inland Revenue Department.

- Filing Taxes: You must file profit tax returns and audited accounts annually.

- Keeping Proper Records: Maintain company and accounting records for at least seven years.

Conclusion

Setting up a business in Hong Kong is refreshingly straightforward compared to many other jurisdictions. The government’s transparent procedures, modern online systems, and efficient support services make the process smooth even for newcomers.

By carefully following the steps outlined above, ensuring all necessary documents are prepared, and meeting post-registration obligations, you can successfully build and run a company in Hong Kong without stress.

At 3E Accounting, we’re committed to making the process as hassle-free as possible. With our expert team of professionals, we offer end-to-end corporate services — from company incorporation and secretarial services to tax advisory and ongoing compliance support. We’ll handle the details, so you can focus on growing your business.

Let 3E Accounting guide your business through the process. Reach out today for expert advice and guidance.

Ready to start your business journey in Hong Kong?

From company setup to tax and compliance, 3E Accounting makes starting a business in Hong Kong seamless and secure. Let our experts handle the details while you focus on your vision.

Frequently Asked Questions

Yes, foreigners can fully own and operate businesses in Hong Kong without restrictions. They can be sole proprietors, partnerships, or limited companies, and can even be the sole director and shareholder. The process for establishing a company in Hong Kong is generally straightforward, and there are no limitations on foreign ownership.

If all the paperwork is in order, online registration usually takes 1–2 business days. If you’re submitting documents in person, it may take around 4–5 days.

Yes, every company must have a registered address in Hong Kong. This can be a commercial office or a virtual office, but it can’t be a P.O. box.

Yes, you must renew your Business Registration Certificate (BRC) every one or three years, depending on your initial selection. The renewal fee varies but is required to keep your business legally active.

In Hong Kong, there is no minimum capital requirement for establishing a company. Many businesses start with a share capital of HKD 1, represented by a single share.

Abigail Yu

Author

Abigail Yu oversees executive leadership at 3E Accounting Group, leading operations, IT solutions, public relations, and digital marketing to drive business success. She holds an honors degree in Communication and New Media from the National University of Singapore and is highly skilled in crisis management, financial communication, and corporate communications.

![5 Steps to Register a Company in Hong Kong Online [2026]](https://www.3ecpa.com.hk/wp-content/uploads/2026/03/5-Steps-to-Register-a-Company-in-Hong-Kong-Online-2026-scaled-110x80.webp)