Thinking of Starting company in Hong Kong? You’re tapping into one of the world’s most dynamic economies. Ranked 2nd globally in economic freedom (Heritage Foundation, 2024) and 5th in the World Bank’s Ease of Doing Business Index, Hong Kong is a top destination for entrepreneurs and global investors.

With a low tax regime, strategic location in Asia, and a transparent legal system based on English common law, Hong Kong offers a pro-business environment where innovation thrives. In 2024, over 1.4 million active companies, including 13,000+ foreign businesses, were registered—clear evidence of its strong international appeal.

Whether you’re launching a new venture or expanding an existing enterprise, this city’s world-class infrastructure, skilled workforce, and access to Mainland China make it an ideal launchpad into Asia.

This blog includes a detailed guide on how to start a business in Hong Kong and everything you need to know in simple, clear terms. From how to register a company in Hong Kong to understanding the tax system, banking, and business opportunities, we’ve got you covered. Let’s dive into how to turn your business vision into a reality, starting in Hong Kong.

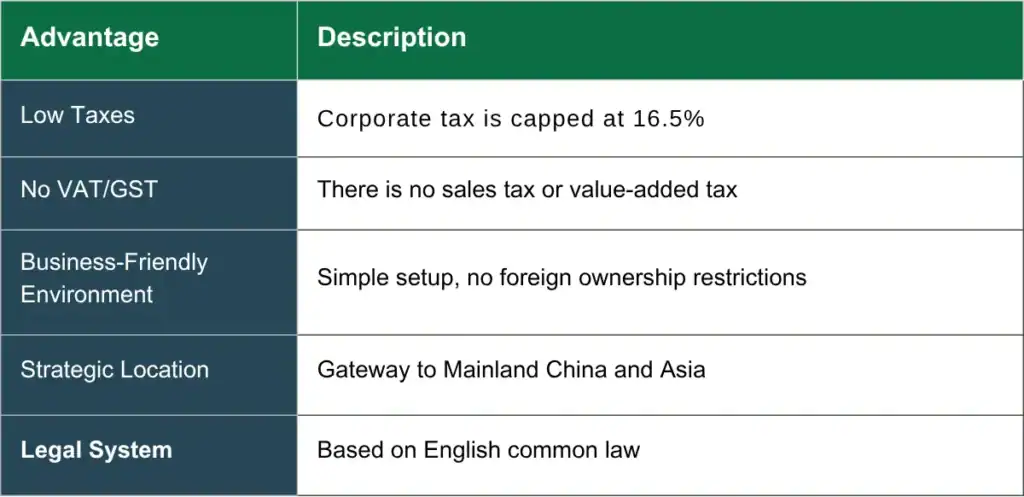

Why is Hong Kong a Good Place to Start a Business?

Hong Kong is considered one of the easiest places in the world to do business. Here’s why:

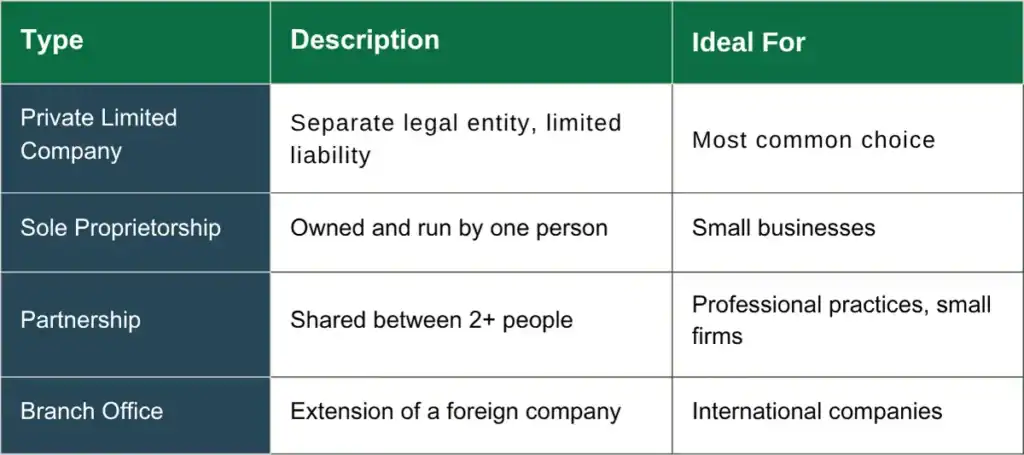

What Types of Business Entities are Available in Hong Kong?

Before registering your company, choosing the proper domain to register for a company business structure is essential. Here are your main options:

How do I Register a Company in Hong Kong?

Setting up a business in Hong Kong is a straightforward process. Here’s how it works:

- Choose a company name – Check if your desired name is available on the Companies Registry.

- Select your business structure – Choose from a private limited company, sole proprietorship, partnership, or branch office.

- Prepare incorporation documents – This includes your Articles of Association and incorporation form.

- Submit to Companies Registry – File your documents with the Hong Kong Companies Registry.

- Get your Business Registration Certificate, which is issued by the Inland Revenue Department.

- Open a corporate bank account – Essential for business operations.

- Apply for relevant licences – Additional licensing may be required based on your business type.

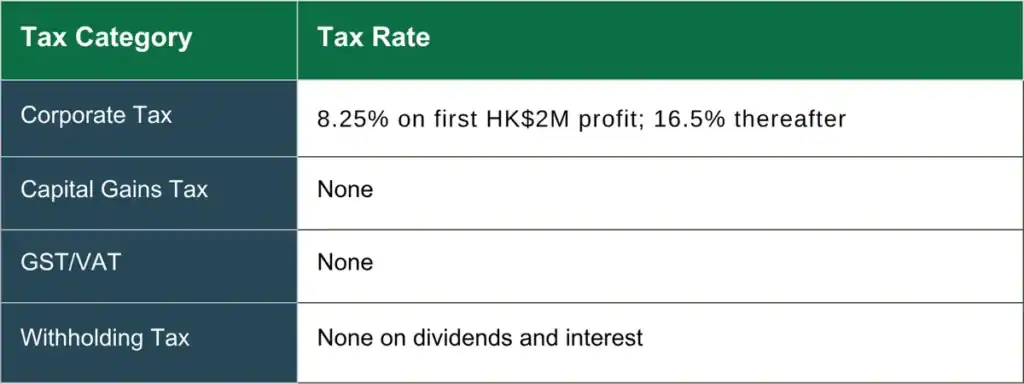

What is the Taxation System in Hong Kong?

Hong Kong’s taxation system is known for its simplicity and low rates. Hong Kong’s tax system includes two main types of taxes:

- Direct Tax: Imposed on income or profits.

- Indirect Taxes: Imposed on transactions, Customs Duty (only applies to tobacco and high-strength liquor).

Here’s a summary of Hong Kong’s taxation system: Here’s a quick overview:

How do I Open a Corporate Bank Account in Hong Kong?

To operate a business, you’ll need a bank account. Here’s what you need:

- Company documents (BR Certificate, incorporation form, etc.)

- Proof of business (invoices, contracts, etc.)

- Personal ID documents for directors and shareholders

Note: Some banks require an in-person meeting.

You’ll first need to complete your company registration before you can open an account. 3E Accounting Services can guide you on the most suitable banks and help with the paperwork.

Read our guide: Corporate Bank Account for Hong Kong Company Incorporation

What Are the Employment and Hiring Rules in Hong Kong?

Hong Kong’s workforce is highly skilled and diverse, making it an excellent location for hiring talent. However, businesses must adhere to the Employment Ordinance and labor laws, which outline employee rights and employer responsibilities.

For hiring foreign employees, companies must sponsor work visas under the General Employment Policy (GEP). This process involves demonstrating that the position cannot be filled by local talent and providing a detailed job description and employment contract.Here are few things to keep in mind while hiring:

- Draft proper employment contracts

- Comply with the Employment Ordinance

- Mandatory Provident Fund (MPF) enrollment is required.

- Observe statutory holidays and leave entitlements.

You can get more info at the Labour Department.You can hire staff once your company is registered, subject to local laws and MPF requirements.

What Are the Compliance Requirements for Hong Kong Companies?

Hong Kong’s regulatory framework is transparent and straightforward. However, companies must adhere to specific requirements to remain compliant:

- Annual Audits: All companies are required to have their financial statements audited by a certified public accountant.

- Tax Filing: Companies must file annual tax returns with the Inland Revenue Department.

- Company Secretary: It is mandatory to appoint a Company Secretary who is a Hong Kong resident or a local entity.

- Registered Office Address: Businesses must maintain a local address for correspondence.

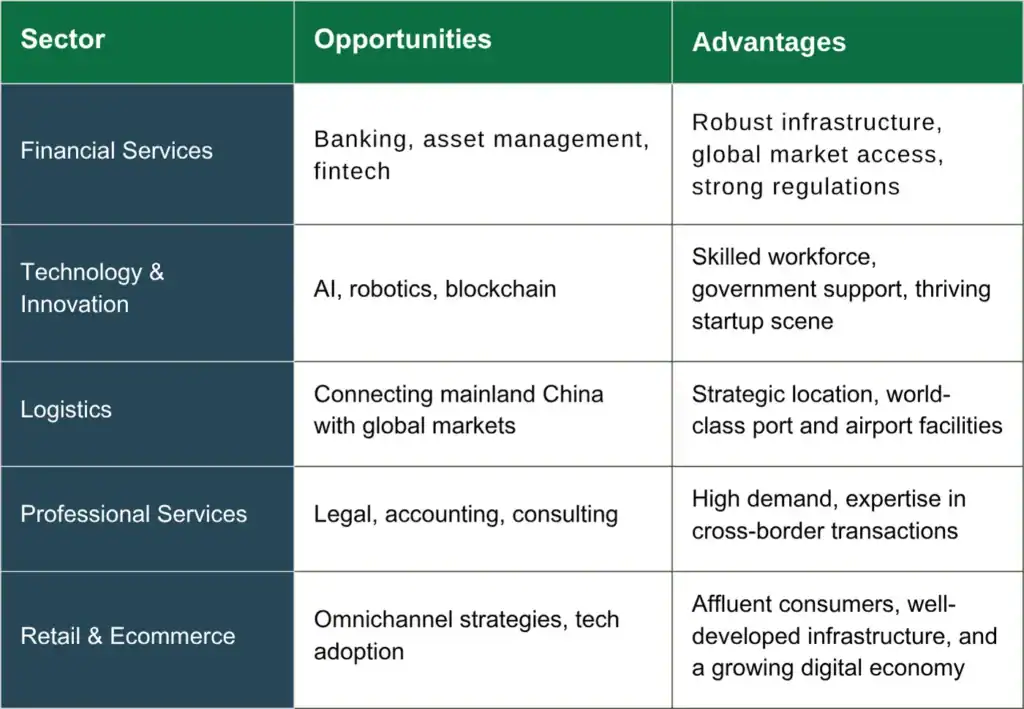

What Business Opportunities Are Available in Hong Kong?

Hong Kong is a vibrant and strategic hub for international businesses looking to expand. Located at the heart of Asia, it offers unparalleled access to surrounding markets, bolstered by a robust economy, a favourable tax regime, and world-class infrastructure.

With a business-friendly environment and strong legal framework, Hong Kong provides unique opportunities for growth and expansion in the global market. By weighing the advantages and challenges, businesses can make informed decisions to leverage Hong Kong’s dynamic landscape for their international ventures.

Read Our Guide: How To Set up Offshore Company in Hongkong 2025 Guide

What are the Various Government Incentives in Hong Kong?

Hong Kong’s government actively supports businesses through various initiatives:

- Innovation and Technology Fund (ITF): Designed to support technology startups and innovation-driven businesses.

- Research and Development Cash Rebate Scheme: Encourages companies to invest in research and development by providing cash rebates.

- Free Trade Policies: Hong Kong’s free port status eliminates duties on imports and exports, fostering international trade.

- Double Taxation Treaties: Agreements with over 40 countries reduce tax burdens for businesses operating across borders.

These policies enhance Hong Kong’s position as a global business hub and make it an attractive destination for companies of all sizes.

Conclusion

If you want to grow internationally, starting a business in Hong Kong could be your smartest move. With its low taxes, simple company registration process, and strategic location in Asia, Hong Kong continues to attract businesses from across the globe. With a reliable legal system, access to skilled talent, and world-class infrastructure, you’ve got the ideal environment for business success.

Whether you’re a solo entrepreneur, SME, or a large multinational, Hong Kong offers flexibility and freedom to operate on your terms. But navigating new markets can be tricky, which is where we come in.

3E Accounting Services is your one-stop solution for doing business in Hong Kong. From incorporation and compliance to tax filing and business advisory, our expert team is here to guide you at every step.

Ready to Incorporate Your Business in Hong Kong?

Let 3E Accounting Services simplify the process and help you set up for long-term success. Contact us today and take the first step towards unlocking Asia’s most dynamic business hub.

Frequently Asked Questions

You can register a company in Hong Kong as a foreigner without any restrictions. You don’t need to be a resident or partner with a local. The process is straightforward and can often be completed online with professional help from 3E Accounting.

Most businesses only need a Business Registration Certificate. However, specific industries (e.g., food & beverage, education, finance) may need additional licences in Hong Kong.

Absolutely. With strong logistics infrastructure, a tech-savvy population, and no sales tax, Hong Kong is ideal for launching regional or cross-border e-commerce operations.

Yes, a single Hong Kong company can operate multiple business activities, provided they’re declared in your business scope and comply with licensing requirements.process.

Yes, you can operate your business virtually as long as you have a registered office address in Hong Kong. Many service providers, including 3E Accounting, offer virtual office solutions.

Yes, Hong Kong has rigorous regulations for all facets of intellectual property, ensuring businesses can confidently innovate with their well-protected assets.

Abigail Yu

Author

Abigail Yu oversees executive leadership at 3E Accounting Group, leading operations, IT solutions, public relations, and digital marketing to drive business success. She holds an honors degree in Communication and New Media from the National University of Singapore and is highly skilled in crisis management, financial communication, and corporate communications.